TradingPro Review

In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with TradingPro. As a leading financial media outlet, our editorial content is driven by rigorous research and data-driven insights, free from external influence. This assessment offers a transparent evaluation of TradingPro’s conditions, tools, support, regulatory standing, and overall suitability for traders.

TradingPro is well-suited for active traders seeking high-leverage options and the benefits of swap-free trading, particularly for those holding longer-term positions. Offering a wide array of instruments across major asset classes, the broker delivers competitive spreads through its various account types. Designed to accommodate both novice and experienced traders, including high-frequency traders, TradingPro ensures a versatile and customized trading experience.

Note: When reviewing TradingPro, it is important to emphasize that they operate several entities across different regions, each with varying levels of regulatory oversight, services, and customer experiences. Therefore, for fairness and accuracy, we have based our scoring on the best-performing region for each of the factors under review.

Broker Overview

Founded in 2017, TradingPro is a multi-asset broker offering access to a diverse range of instruments, including forex, indices, precious metals, oil, cryptocurrencies, and equities.

The broker supports trading on MetaTrader 4 and 5 platforms, cTrader and has mobile accessibility, providing traders with advanced tools and analytics through these various platforms.

TradingPro is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider and its Global business by the Financial Services Commission in Mauritius as an Investment Dealer (Full Service). These regulatory approvals ensure the broker adheres to industry standards, offering traders some security and transparency.

The broker offers competitive and flexible trading conditions, with a minimum deposit requirement of $1 and leverage available up to 2000:1. Traders can select from several base currencies, such as USD, GBP, EUR, AUD, CAD and JPY, to match their preferences.

TradingPro provides 24/7 customer support via email, phone, and live chat, messenger, and Instagram, ensuring that traders have access to assistance whenever needed.

Key Details

- Regulated Geos/Regions: FSCA (South Africa), FSC (Mauritius)

- Deposit/Withdrawal Currencies/Crypto: USD, GBP, EUR, AUD, CAD, JPY, USC

- Minimum Deposit: Micro and Rookie accounts $1, Pro Account $10, ScalpX account $50

- Bonuses/Promotions: Cashback, $50 Credit Bonus, Partnership Program

- Costs (spreads, fees, commissions): Spreads from 1.6 pips, Swap-Free, Social Trading Fees

- Tradable Asset Classes: Forex, Commodities, Metals, Indices, Equities, Cryptos

- Leverage: Up to 2000:1 for Forex, 300:1 for Gold and Silver, 100:1 for Oil, 10:1 for Crypto

- Trading Platforms Allowed: MT4, MT5, cTrader, Mobile Apps

- Restricted Regions: Australia, Belgium, France, Iran, Japan, North Korea, Canada, USA

- Customer Service Languages: English, Malay, and 10 other languages via Dashboard

TradingPro Account Conditions Score

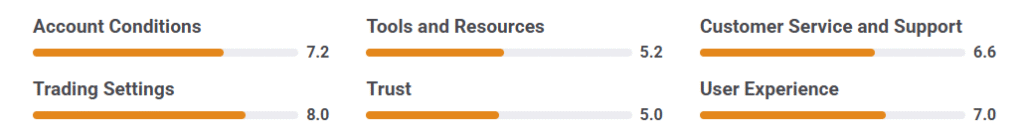

Account Conditions

Score: 7.2

Regulated Regions

TradingPro International (PTY) LTD is regulated as a Financial Services Provider by the Financial Sector Conduct Authority (FSCA) of South Africa.

TradingPro International Limited is regulated by the Financial Services Commission (FSC) in Mauritius.

However, TradingPro does not accept clients from countries including Australia, Belgium, France, Iran, Japan, North Korea, Canada, and the USA.

Currencies Accepted for Deposits and Withdrawals

TradingPro allows deposits in a range of currencies, including US Dollar, GBP, EUR, AUD, CAD, JPY, and USC (USD Stablecoin).

Deposits can be made via multiple methods, such as credit cards, e-wallets, cryptocurrencies, and regional payment systems like PromptPay and Dragonpay. Credit and debit card deposits are processed instantly, alongside cryptocurrency and some regional methods like Neteller and SticPay. Bank transfers usually clear within one business day.

Withdrawals are typically processed within one day, regardless of the payment method. However, withdrawals must first be processed through the original deposit method until the initial deposit is fully returned.

Account Types

TradingPro offers several account types tailored to traders with different needs and experience levels:

- Micro Account: Designed for beginners with a minimum deposit of $1, this account offers access to 38 forex pairs, precious metals, and oil with variable spreads starting from 1.6 pips, and no commission on trades.

- Rookie Account: Ideal for novice and experienced traders, this account requires a minimum deposit of $1 and features variable spreads from 0 pips. A commission of $3 per lot per roundtrip applies. Traders gain access to a broader range of instruments compared to the Micro Account.

- Pro Account: A commission-free account aimed at seasoned traders, with a minimum deposit of $10 and variable spreads starting from 1.6 pips. Traders can access forex pairs, oil, precious metals, and indices.

- ScalpX Account: Perfect for experienced traders who focus on high-volume trading and scalping. With spreads starting from 0.0 pips and a commission of $3 per lot per roundtrip, this account provides access to a wide array of instruments including equities and crypto CFDs. The minimum deposit is $50.

TradingPro also offers Islamic swap-free accounts for all account types.

Minimum Deposit

- Micro and Rookie Accounts: $1 USD

- Pro Account: $10 USD

- ScalpX Account: $50 USD

Costs and Fees

Spreads for the Micro and Pro Accounts start from 1.6 pips, though specific spread values for individual instruments are not detailed on the website.

The Rookie and ScalpX Accounts feature spreads starting from 0 pips, with a commission of $3 per lot per roundtrip.

Islamic Accounts are available with no swap charges, though other commission fees and spreads may apply depending on the selected account type.

Additional Fees:

- No rollover fees (swap fees) for overnight positions.

- No inactivity fee.

- Deposits are free of charge, but some deposit methods may incur third-party fees or have specific conditions (e.g., minimum deposit amounts, processing times).

Bonuses and Promotions

TradingPro provides several promotions, including:

- Cashback Program: Offers rebates on executed trades, reducing transaction costs. Rookie and ScalpX accounts earn $1 USD per lot, while Micro and Pro accounts earn $2 USD per lot.

- $50 Credit Bonus: Exclusively available to participants of specific expos, this bonus requires a minimum deposit of $500 USD on the ScalpX account and specific conditions for withdrawal.

- Partnership Program: TradingPro’s Partnership Program offers affiliates and Introducing Brokers (IBs) a competitive commission structure, allowing them to earn up to $14 per lot on forex and metal trades made by referrals, depending on the account type.

Depositing Ease

TradingPro offers a variety of deposit methods based on your region. The available payment options include credit/debit cards (Visa, Mastercard), bank transfers, and e-wallets like WalaoPay, FasaPay, and Paytrust. Cryptocurrencies and virtual accounts are also accepted, alongside regional payment systems like PromptPay, Dragonpay, Neteller, and Perfect Money.

Minimum deposit amounts vary depending on the method chosen:

- Visa, Mastercard, and Crypto payments: Minimum deposit of $100 USD.

- WalaoPay, FasaPay, and Paytrust: Minimum deposit of $10 USD.

- Virtual Account: $23 USD.

- PromptPay: 300 THB, Dragonpay: 2500 PHP.

Withdrawing Ease

Withdrawal options are available via various methods, including bank transfers, credit/debit cards, and e-wallets like Neteller and Skrill. Traders must use the same withdrawal method as the deposit method, and the currency must match the deposit currency.

Withdrawals are typically free of charge and processed within one business day. However, some methods may incur fees when transferring funds to personal accounts. Minimum withdrawal amounts depend on the chosen method:

- Visa, Mastercard, and Crypto payments: Minimum withdrawal of $100 USD.

- FasaPay: $10 USD.

- WalaoPay, Paytrust: $15 USD.

- Virtual Account: $23 USD.

- PromptPay: 300 THB, Dragonpay: 2500 PHP.

Note: Withdrawals must be made to accounts in the trader’s name due to regulatory requirements, and third-party transactions are not permitted.

In our experience, withdrawal options in the UK were quite limited, with only Crypto, Neteller, and SticPay available. We encountered some delays and additional costs during the process, particularly due to bank transfer fees and unfavorable exchange rates. As a result, the withdrawal process was relatively slow and costly.

TradingPro Trading Experience Score

Experience Score: 8.0 / 10

Tradeable Assets

TradingPro offers a wide range of instruments like forex, commodities, indices, stocks, and cryptocurrencies.

Each account gives access to different instruments. The ScalpX account has the most options.

Micro Account (MT4): 38 forex pairs, 5 commodities (Gold, Silver, Oil, Natural Gas, WTI).

Rookie Account (MT4): 52 forex pairs, 6 commodities.

Rookie Account (MT5): 40 forex pairs, 2 metals (Gold and Silver).

Pro Account (MT4): 38 forex pairs, 5 commodities, 14 indices.

ScalpX Account (MT4): 52 forex pairs (7 major, 45 cross/exotic), 5 commodities, 14 indices, 134 stocks, and 11 cryptos.

Available cryptos: Bitcoin, Ethereum, Litecoin, Ripple, Dogecoin, Cardano, Chainlink, Polkadot, EOS, Stellar, Bitcoin Cash.

Note: Crypto trading may be restricted in some countries due to local laws. Options, ETFs, and bonds are not available.

Lot Sizes

Micro Account: Min. trade size is 0.10 lot.

Rookie, Pro, ScalpX: Min. 0.01 lot for forex and commodities.

Pro & ScalpX: Min. 1.0 lot for indices. ScalpX also has 1.0 lot minimum for stocks and 0.01 lot for crypto.

Leverage

TradingPro offers high leverage—up to 2000:1 for forex. You can adjust it as you wish.

Forex: up to 2000:1

Gold & Silver: 300:1

Oil & Indices: 100:1

Crypto: 10:1

Leverage depends on your account balance:

$501 – $5,000 = 1000:1

$5,001 – $10,000 = 500:1

$10,001 – $50,000 = 300:1

$50,001 – $100,000 = 200:1

$100,001 – $2,000,000 = 100:1

Stop-out Levels (when trades are auto-closed):

Micro: 10%

Pro: 20%

Rookie & ScalpX: 30%

This helps protect your account from going negative.

Execution Quality

TradingPro uses Market Execution, meaning trades are filled at the market price. Their servers are based in London for fast execution.

During our tests, orders were executed quickly with very little slippage—even during high volatility (like NFP news). One time we even got a better price than expected.

TradingPro Tools and Resources

Score: 5.2 / 10

Platforms

You can trade on MT4, MT5, or cTrader—on both desktop and mobile. These platforms are reliable and packed with features.

We had a small issue on MT4 (drawing tools showing on other charts), but it was fixed after restarting.

Tools Available

Trading Central

Economic calendar

Trading glossary

FAQ page

These are helpful, but limited. If you’re looking for deep learning resources, TradingPro might not have enough.

Copy Trading & PAMM

TradingPro offers several copy trading account types:

Copy Cent: For beginners—uses cents for smaller risks.

Copy Micro: For small trades with low capital.

Copy Pro: For experienced traders.

Copy ScalpX: For scalpers who like fast trades.

Demo accounts are also available.

TradingPro Trust Score

Score: 5.0 / 10

Regulation

South Africa: Registered with the FSCA as a financial service provider (FSP No. 49624).

Mauritius: Fully licensed by FSC Mauritius as an investment dealer (GB23202513).

Note: The South African license is for financial services, not directly as a broker.

Client Protection

Negative Balance Protection: Your account won’t go below zero.

Restricted Countries: No clients from the US, Australia, France, Japan, Iran, Canada, North Korea, and others due to regulations.

Awards

TradingPro has won:

Best Micro Forex Broker (South Africa, Smart Vision Summit 2024)

Best Spreads Global (India, Money Expo 2024)

Forex Broker of the Year (Cyprus, Forex Traders Summit 2024)

These awards are nice, but should be considered along with regulation, platform quality, and service.

TradingPro Customer Support

Score: 6.6 / 10

Availability

Support is available 24/7 through:

Live Chat

Email

WhatsApp

Messenger

Line

Instagram

Telegram

- Live chat replies were fast—within minutes. Email tickets were answered in a few hours.

However, some answers were basic and pointed us to the website, which lacked full explanations. Follow-up was often needed for clear info.

Languages

Main support languages: English and Malay.

Other languages on the website include: Thai, Indonesian, Hindi, Arabic, Chinese, Japanese, and Vietnamese.