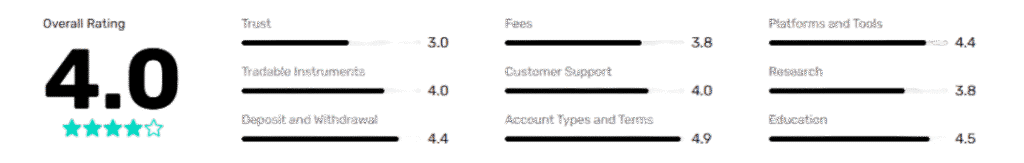

Our Perspective on Headway

Established in 2022, Headway is a globally oriented CFD broker headquartered in East London, South Africa. The platform provides access to a wide range of CFD instruments, including forex, indices, commodities, shares, and cryptocurrencies—available through the renowned MetaTrader 4 and MetaTrader 5 platforms.

Headway’s Standard Account features spreads that range from competitive to slightly above average, while the Pro Account offers ultra-tight spreads starting from 0.0 pips. What truly sets Headway apart is its proprietary copy trading system, user-friendly mobile app, and innovative offerings such as tokenized real estate.

With responsive live chat support, demo accounts, and a dedicated forex education course, Headway proves to be an accessible option for novice traders. Meanwhile, the advanced capabilities of the MetaTrader platforms, fast execution speeds, and raw spread accounts make it a compelling choice for day traders, scalpers, and algorithmic traders alike.

Advantages of Trading with Headway

Competitive EUR/USD Spreads — Enjoy tight spreads, especially on major pairs.

Diverse Account Options — Tailored account types to suit varying trader needs.

Integrated Copy Trading — Leverage the strategies of successful traders through a proprietary platform.

Extensive Crypto Selection — Access a wide range of cryptocurrency pairs.

Micro-Lot Trading Available — Ideal for risk-conscious or beginner traders.

Efficient Transactions — Benefit from fast deposit and withdrawal processing.

Beginner-Friendly Education — Includes a dedicated forex course for new traders.

Potential Drawbacks

Regulatory Oversight — Operates under limited regulatory supervision.

Lack of Phone Support — Customer support is only available via chat and email.

Limited Asset Variety — Does not offer trading in soft commodities.

Who Is Headway For?

At Headway, trading isn’t one-size-fits-all. We’ve assessed the broker’s features to see how well they support different trading strategies and trader profiles. Here’s our verdict:

✅ Casual Trading: Ideal Fit

Headway is an excellent choice for beginners and casual traders. With micro-lot trading, educational resources, responsive customer support, and demo accounts, it provides a low-risk environment to learn and grow. Although MetaTrader desktop platforms have a learning curve, the MT5 web version offers a more user-friendly experience for new traders.

✅ Copy Trading: Ideal Fit

Headway stands out with its proprietary copy trading platform, available through both the client portal and mobile app. Traders can effortlessly replicate the strategies of seasoned professionals or share their own trades with others.

🟡 Swing Trading: Decent Option

With access to over 250 stocks from US, German, and Brazilian markets, Headway supports swing trading fairly well. That said, the absence of real shares and ETFs, along with average overnight fees, limits its appeal for long-term position holders.

🟡 Day Trading: Decent Option

MT4 and MT5 provide key features like one-click execution and trading directly from charts, suitable for fast-paced day traders. However, relatively wide spreads on some assets may increase trading costs for frequent market participants.

🟡 Scalping: Decent Option

Scalpers can benefit from quick order execution and tools like depth of market (DOM) on MT5. Yet, the lack of VPS hosting might impact execution speed and stability — critical elements for high-frequency trading.

🔴 News Trading: Not Recommended

While MT5 includes an integrated economic calendar, Headway does not offer real-time news updates or in-depth analysis of economic events, making it less suitable for news-driven strategies.

🟡 Automated Trading: Decent Option

Headway supports automated trading through MetaTrader’s expert advisors (EAs) and backtesting capabilities. However, the absence of VPS hosting may hinder performance for traders reliant on consistent uptime and rapid execution.

🟡 Investing: Decent Option

Headway’s NOVA platform lets users invest in tokenized real estate with a low entry point of $50, offering an innovative investment angle. Still, the lack of traditional instruments like stocks, ETFs, and bonds may be a drawback for long-term investors.

What Makes Headway Stand Out?

In our review, Headway impressed us with its seamless registration process and user-friendly client portal. We also found it to be highly accommodating for crypto enthusiasts, offering a wide range of tradable crypto pairs and the flexibility to deposit and withdraw using cryptocurrencies.

Although Headway does not provide a proprietary trading platform, it makes up for it with a robust copy trading system and innovative products such as tokenized real estate.

Note: This review was conducted using a Standard Account via the MetaTrader 5 desktop platform and mobile app, under the Jarocel Pty Ltd entity. Please note that available features and services may vary depending on your country of residence.

Headway Broker Main Features

| Feature | Details |

|---|---|

| Regulations | FSCA (South Africa) |

| Supported Languages | Arabic, Bengali, Bulgarian, Chinese, Czech, Croatian, Dutch, English, Estonian, Finnish, French, Georgian, German, Greek, Hebrew, Hindi, ... +17 more |

| Products | Currencies, Stocks, Crypto, Indices, Commodities |

| Min Deposit | $1 |

| Max Leverage | 1:500 (FSCA) |

| Trading Desk Type | Principal Model |

| Trading Platforms | MT5, MT4, Headway App |

| Deposit Options | Cryptocurrencies, Visa, Mastercard, Local Banks |

| Withdrawal Options | PerfectMoney, Cryptocurrencies, Visa, Mastercard |

| Demo Account | Yes |

| Foundation Year | 2022 |

| Headquarters Country | South Africa |

Broker Headway Full Review

Trust & Regulation: Is Headway Safe?

Summary:

Founded in 2022, Headway is a relatively new player in the CFD trading space. The broker operates under a single entity — Jarocel Pty Ltd, which is authorized and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa.

Despite its recent entry, Headway demonstrates a commitment to transparency and client protection by offering segregated client funds and negative balance protection. However, it currently does not provide a formal compensation scheme.

| Entity Features | JAROCEL PTY LTD |

|---|---|

| Country/Region | South Africa / Global |

| Regulation | FSCA |

| Regulatory Tier | 2 |

| Segregated Funds | Yes |

| Negative Balance Protection | Yes |

| Compensation Scheme | No |

| Maximum Leverage | Up to 1:Unlimited |

Headway Regulation Overview

As part of our trust evaluation, we assess the regulatory status of each entity operated by a broker. This helps us determine the level of protection clients can expect. We classify regulators into a three-tier system, with Tier 1 representing the highest standard of oversight and investor protection.

For Headway, we found that the broker operates under a single entity:

- Jarocel Pty Ltd is licensed and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa, under registration number 2021/883863/07. Based on our internal rating system, the FSCA is considered a Tier 2 regulator — offering a moderate level of protection for retail clients.

Understanding the Regulatory Protections of Your Account

When choosing a broker, it’s essential to understand the level of regulatory protection associated with your trading account. While brokers often operate under multiple entities to serve clients worldwide, the safeguards provided can vary significantly depending on the jurisdiction. Here’s how Headway measures up under its FSCA-regulated entity:

🔐 Segregation of Client Funds

Headway keeps client funds in segregated bank accounts, separate from the company’s operational capital. This helps protect traders from potential mismanagement or misuse of funds and adds a layer of security against fraud.

🛡️ Negative Balance Protection

With negative balance protection, your losses can never exceed your deposited amount. This means that even during extreme market volatility, your account cannot go into the negative — a crucial feature for risk-conscious traders. Headway includes this protection as standard.

⚠️ No Compensation Scheme

Unlike some brokers operating under Tier-1 regulators, Headway does not offer a compensation scheme. In the rare event of broker insolvency, clients are not covered by insurance or fund protection programs.

⚖️ High Maximum Leverage

Headway allows leverage up to 1:Unlimited, which can magnify both profits and losses. However, this high leverage is only available on account balances of $1,000 or less, serving as a built-in risk control for larger accounts.

Stability and Transparency

As part of our Trust evaluation, we also examine a broker’s stability and transparency—focusing on its operational history, organizational scale, and how openly it shares key information.

Headway was established in 2022, marking it as a relatively new entrant in the trading industry. According to its LinkedIn profile, the company employs between 51 to 200 people, classifying it as a small-scale brokerage firm.

During our review of Headway’s official website (hw.online) and its social media presence, we found a fair degree of transparency. Details related to trading conditions, regulatory status, and company background were clearly presented. Legal documentation, including terms and conditions, was easily accessible and even available in nine local languages to accommodate a global user base.

The broker’s regulatory details are displayed in the website footer.

Trading fees are explained on the “Account Types” page.

Specifics regarding account conditions can be found in the Legal Documents section on the “About Us” page.

Is Headway Safe to Trade With?

While Headway offers several trader protection features, its overall Trust score is moderate due to certain limitations.

⚠️ Points of Concern:

Regulated by only one authority (FSCA – South Africa)

Limited operating history (founded in 2022)

No compensation scheme in place for client protection in case of insolvency

✅ Strengths:

Negative balance protection provided

Segregated client funds to ensure financial safety

A transparent approach to fees, regulation, and documentation

In conclusion, while Headway may lack some of the safety nets offered by more established, multi-regulated brokers, it demonstrates a commendable level of transparency and foundational safeguards that may appeal to cautious but cost-conscious traders.

Trading Fees at Headway

📉 Spreads

To evaluate Headway’s spreads, we conducted live tests during the London open and after the New York open on 16 December 2024 — periods known for high liquidity and tight pricing.

| Instrument | Live Spread (AM) | Live Spread (PM) | Industry Average |

|---|---|---|---|

| EUR/USD | 0.9 pips | 0.8 pips | 1.08 pips |

| GBP/JPY | 3.9 pips | 3.8 pips | 2.44 pips |

| Spot Gold | 35 cents | 32 cents | 25 cents |

| WTI Oil | 6 cents | 6 cents | 3 cents |

| Apple | n/a | 2 cents | 33 cents |

| Tesla | n/a | 8 cents | 5 cents |

| DAX 40 | 1 pip | 1 pip | 2.4 pips |

| Dow Jones 30 | 2.5 pips | 2.5 pips | 3.3 pips |

| Bitcoin | $30.10 | $30.10 | $35.50 |

Insight: Spreads on major forex pairs like EUR/USD, as well as indices, shares, and crypto, were highly competitive. However, commodities and minor forex pairs showed room for improvement.

💱 Swap Fees

Swap fees are the cost (or credit) for holding a position overnight. We recorded data on 28 October 2024 for one full contract (100,000 units of the base currency).

| Instrument | Swap Long | Swap Short |

|---|---|---|

| EUR/USD | Charge of $6.33 | Credit of $1.46 |

| GBP/JPY | Credit of $15.20 | Charge of $41.20 |

Insight: Headway’s swap fees are standard for the industry — neither too high nor too low.

🚫 Non-Trading Fees

- No account maintenance or inactivity fees

- No deposit or withdrawal handling charges

💬 Are Headway’s Fees Competitive?

Overall, Headway offers a mixed fee structure:

- ✅ Tight spreads on major FX pairs, indices, shares, and crypto

- ⚠️ Wider spreads in some commodities and minor forex pairs

- ➖ Swap fees in line with industry average

- ✅ No non-trading fees like inactivity or withdrawal charges

- ✅ Raw spreads account available for tighter pricing

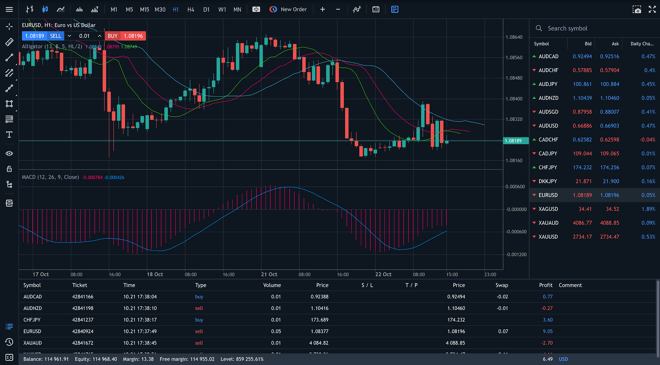

📊 Platform and Tools

Summary:

Headway supports a range of trading platforms to suit various trader profiles. It offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for desktop, web, and mobile use—ideal for advanced users and those who rely on automated strategies. In addition, Headway provides its own mobile app and copy trading platform, making it easy for users to trade, copy strategies, and manage transactions while on the go.

| Platform/Tool | Suitable For |

|---|---|

| MetaTrader 4 (Desktop, Web) | Experienced Traders, Day Trading, Scalping, Algo Trading, MAM/PAMM, Trading Signals |

| MetaTrader 5 (Desktop, Web) | Experienced Traders, Day Trading, Scalping, Algo Trading, MAM/PAMM, Trading Signals |

| MetaTrader App | Mobile trading, day trading, swing trading, account management |

| Headway App | Copy trading, deposits/withdrawals, chat support, trading via MT4/MT5 within the app |

| Headway Copy Trading Platform | Copying and sharing trading strategies |

💻 MetaTrader 5 Desktop Platform

During my live testing, I used the MetaTrader 5 (MT5) desktop platform — a powerful and versatile tool designed for both novice and professional traders. MT5 is available in 52 languages, ranging from Arabic to Vietnamese, making it accessible to a global audience.

The platform includes a wide range of advanced features, including:

🔔 Price Alerts

Stay informed with custom alerts that notify you when a specific instrument reaches a designated price level.📋 Watchlists

Create and manage a personalized list of your favorite trading instruments, and monitor live quotes in real-time via the market watch panel.⚡ One-Click Trading

Execute trades instantly with a single click, without the need for secondary confirmation — ideal for scalpers and short-term traders who prioritize speed.📈 Trading Directly from Charts

MT5 allows seamless order placement directly from price charts, enhancing precision and convenience for technical traders.

With its robust functionality, MT5 remains a go-to platform for traders who demand speed, flexibility, and advanced analytical tools.

📊 MT5 Desktop Charts

MetaTrader 5 is well-known for its powerful and flexible charting capabilities, making it a favorite among technical traders. Here’s what the platform offers:

📉 38 Built-in Technical Indicators

Includes widely-used tools such as trend indicators, volume indicators, and oscillators to support a variety of trading strategies.📐 44 Analytical Objects

Access a wide range of drawing tools, including lines, channels, Gann tools, and Fibonacci retracement levels for detailed market analysis.⏱️ 21 Time Frames

Traders can view the market from multiple perspectives, with time frames ranging from 1 minute to 1 month.📈 3 Chart Types

Choose from Bar Charts, Japanese Candlestick Charts, or Line Charts to suit your trading style and preferences.🔁 Copy Trading (Trading Signals)

MT5 allows users to follow and copy the trades of other experienced traders in real-time through integrated trading signals.🤖 Automated Trading with Expert Advisors (EAs)

Develop, test, and deploy custom trading algorithms. MT5 supports fully automated trading strategies through its built-in Expert Advisor framework.

With this robust suite of tools, MetaTrader 5 Desktop offers everything traders need for detailed analysis, real-time decision-making, and automated execution.

🧾 MT5 Desktop Orders

MetaTrader 5 provides a comprehensive range of order types, giving traders the flexibility to implement a variety of trading strategies and manage risk effectively. Here’s a breakdown of the available order types on the platform:

📌 Market Order

Executes a trade immediately at the best available market price. Ideal for traders looking to enter or exit a position quickly.🎯 Limit Order

Places a buy or sell order at a specific price or better. Commonly used when waiting for the market to reach a more favorable level.⛔ Stop-Loss Order

Automatically triggers a buy or sell when the instrument hits a predefined price level. This helps to minimize potential losses.🛑 Stop-Limit Order

A more advanced risk management tool that combines the features of a stop-loss and a limit order. Once the stop price is reached, a limit order is placed at the specified price.📉 Trailing Stop Order

A dynamic stop-loss that adjusts with the market price. It locks in profits as the market moves in your favor, while still protecting you if the market reverses.

With these order types, MetaTrader 5 Desktop equips traders with the control and precision needed to manage both entry and exit points in all market conditions.

📝 MT5 Desktop: Key Takeaways

The MetaTrader 5 desktop platform remains one of the most advanced and widely used platforms in the retail trading space. It is packed with powerful tools for market analysis, automation, and order execution.

While its extensive feature set may present a steep learning curve for beginners, experienced traders will appreciate the expanded functionality compared to MT4.

Key highlights of MT5 Desktop include:

A larger selection of technical indicators, graphical tools, and analytical objects than MT4

Built-in economic calendar to track important market events directly from the platform

Depth of Market (DOM) feature, providing insight into market liquidity and order book dynamics

For serious traders seeking flexibility, advanced analytics, and automation tools, MT5 Desktop offers a robust and professional-grade experience.

MetaTrader 5 WebTrader

Traders can seamlessly access the MetaTrader 5 WebTrader directly from Headway’s client portal. Unlike the desktop version, the MT5 WebTrader is designed with a cleaner, more user-friendly interface, making it ideal for beginners and traders who prefer a simplified experience.

No downloads or installations are needed — all you need is an internet connection. The web platform works flawlessly across all major browsers and operating systems.

Key features of the MT5 WebTrader include:

⚡ One-Click Trading – Place orders instantly with a single click

📈 Trading from the Chart – Execute trades directly from live price charts

📋 Custom Watchlists – Monitor your favorite instruments with real-time quotes

📊 Trade History – Track past trades with a clear and organized view

🖥️ Advanced Charting – Analyze the markets with professional-grade tools right from your browser

Whether you’re on the go or prefer a lightweight trading interface, MT5 WebTrader delivers essential functionality without sacrificing performance.

📊 MT5 WebTrader Charts

The charting capabilities on MT5 WebTrader are impressive, offering a streamlined yet powerful experience directly within your browser. While slightly more lightweight than the desktop version, it still provides the essential tools needed for technical analysis.

Key charting features include:

📉 31 Built-in Technical Indicators

Including popular trend-following tools, volume indicators, and oscillators—ideal for most trading strategies.📐 4 Analytical Objects

Traders can apply tools like trend lines, regression channels, Gann tools, and Fibonacci retracement for deeper market insights.⏱️ 9 Time Frames

From 1-minute to 1-month, the platform allows traders to view the market across multiple time intervals.📈 3 Chart Types

Choose from Bar Charts, Japanese Candlestick Charts, and Line Charts—whichever suits your trading style best.

Whether you’re performing quick intraday analysis or building longer-term strategies, MT5 WebTrader offers intuitive and effective charting tools that work anywhere, anytime.

💼 Tradable Instruments at Headway

Summary:

Headway provides access to over 380 tradable instruments, including forex, indices, commodities, shares, and cryptocurrencies. The broker offers a balanced selection across major global markets and caters well to Southeast Asian traders by including a range of Indonesian instruments, particularly in the shares, indices, and FX categories.

However, the overall product lineup could be expanded further with instruments such as CFDs on bonds and ETFs, which are not currently available.

| Instrument | Number | Type | Industry Average |

|---|---|---|---|

| Forex Pairs | 57 | Major, Minor, Exotic | 30–75 |

| Commodities | 6 | Metals, Energies | 10–20 |

| Indices | 34 | US, UK, European, Asian, and Australian | 10–40 |

| Stocks | 263 | US and global exchanges | 200–300 |

| Cryptocurrencies | 21 | Major and Minor | 10–20 |

🌍 Global Coverage with Local Touch

The breadth of tradable instruments at Headway is comparable to industry standards, particularly in the stocks and forex categories. With 263 stocks and 57 currency pairs, traders have access to a solid variety of assets.

What sets Headway apart is the inclusion of Indonesian shares and instruments, which makes it attractive for regional traders seeking local exposure.

💱 Strength in Crypto, Room to Grow in Commodities

Headway demonstrates particular strength in the cryptocurrency space, offering a diverse mix of crypto pairs, including:

– BTC/THB – Bitcoin vs. Thai Baht

– BTC/XAG – Bitcoin vs. Silver

However, the range of commodities could be improved. Currently, the offering focuses on metals and energies, but lacks agricultural products like soybeans or coffee.

⚖️ Final Thoughts

- ✅ Strong in forex, shares, and crypto

- ⚠️ Limited commodity selection

- ❌ No CFDs on ETFs or bonds

Headway provides a well-rounded selection of instruments for most retail traders. Expanding into ETFs, bonds, and a broader commodity range would further enhance its value for long-term investors.

📘 What Are CFDs?

A Contract for Difference (CFD) is a financial instrument that allows traders to speculate on the price movements of an asset without owning the asset itself. The buyer agrees to pay the seller the difference between the asset’s current value and its value at the time the contract is closed.

CFDs are commonly used in online trading due to their flexibility and accessibility. They cover a wide range of assets, and enable both long (buy) and short (sell) positions, giving traders the opportunity to profit in rising or falling markets.

📊 What Can You Trade with Headway?

To give a clearer picture of Headway’s market offering, here are examples of tradable instruments across different asset classes:

💱 Forex Major:

EUR/USD, USD/CHF, USD/JPY💱 Forex Minor:

GBP/CHF, EUR/AUD, GBP/JPY🌐 Forex Exotic:

DKK/JPY, [2], [3]🪙 Metals:

Gold, Silver⛽ Energies:

WTI Crude Oil, Brent Crude Oil, Natural Gas📈 Indices:

AUS200, STOXX50, NASDAQ100🏢 Shares:

Netflix, Walmart, Intel💹 Cryptocurrencies:

Solana, Bitcoin, Polkadot

This diverse lineup ensures that traders can build a portfolio across traditional and emerging markets, from forex and commodities to stocks and crypto.

📞 Customer Support

Summary:

Headway provides 24/7 customer support through live chat and email. While phone support is not available, the broker’s live chat agents were quick to respond—typically within seconds—and email responses arrived within 24 hours. However, support staff were better at handling simple inquiries, and tended to struggle with more complex or technical issues.

🤝 Why Customer Support Matters

Customer support plays a crucial role in a trader’s experience, especially in moments of uncertainty, technical issues, or urgent trade decisions. Whether you’re a beginner seeking guidance or a seasoned trader dealing with execution problems, timely and competent assistance can make a big difference.

🧪 Headway Customer Support Test: Our Experience

To evaluate Headway’s support quality, I conducted multiple tests over a two-week period using both live chat and email channels. Here’s what I found:

Live Chat Experience:

Accessing live chat requires entering your name and email before being connected to an agent. Once connected, the response was fast and professional. The agents could handle basic questions, such as inquiries about inactivity fees or minimum deposit requirements.

However, they were less helpful when asked more technical questions, such as those involving segregated funds or margin calculation.Email Support:

I received responses to email inquiries within 24 hours — faster than many competitors in the industry. Answers were clearly written, though again, more complex queries were sometimes met with vague or generic responses.Limitations:

The absence of phone support is a drawback, particularly for urgent or high-stakes issues where immediate verbal communication could be more effective.

📲 Additional Contact Options

Although Headway doesn’t offer phone support, they are reachable through:

WhatsApp

Telegram

These additional channels may offer a more conversational experience for users who prefer messaging apps over traditional email or live chat.

✅ Verdict

Headway’s customer support is quick and accessible, especially for everyday questions. While it lacks depth in handling technical inquiries and does not provide phone support, the inclusion of 24/7 live chat and responsive email support ensures that most users’ concerns are addressed in a timely manner.

💳 Headway Deposit Methods

| Method | Fees | Processing Time |

|---|---|---|

| Visa/Mastercard | 0% | 15 to 30 minutes |

| Tether | 0% | 15 to 30 minutes |

| Litecoin | 0% | 15 to 30 minutes |

| Bitcoin | 0% | 15 to 30 minutes |

| Ethereum | 0% | 15 to 30 minutes |

| Dogecoin | 0% | 15 to 30 minutes |

Deposits are quick and easy, with no fees applied.

💸 Headway Withdrawal Methods

| Method | Fees | Processing Time |

|---|---|---|

| Visa/Mastercard | $10 | Immediate |

| Perfect Money | 0% | Immediate |

| Tether | 0% | Immediate |

| Litecoin | 0% | Immediate |

| Bitcoin | 0% | Immediate |

| Ethereum | 0% | Immediate |

| Dogecoin | 0% | Immediate |

📂 Account Types and Terms

📝 Headway Account Opening Process

Opening an account with Headway is simple. Clients only need to provide their name, email address, and create a password. After registration, they gain access to the client portal where they can create both live and demo accounts.

For credit card deposits, identity verification is required using a national ID, along with the user’s date of birth and address.

💡 Headway Account Types and Their Benefits

| Feature | Cent | Standard | Pro |

|---|---|---|---|

| Minimum deposit | $1 | $10 | $100 |

| Base currencies | USD | USD, EUR, IDR, JPY, THB, NGN, ZAR, BRL, MYR | USD, EUR, IDR, JPY, THB, NGN, ZAR, BRL, MYR |

| Spread | Floating from 0.3 pips | Floating from 0.3 pips | Floating from 0.0 pips |

| Instruments | 300+ | 300+ | 350+ |

| Commission | No | No | Up to $1.50 each side per lot |

| Minimum lot size | 0.01 | 0.01 | 0.1 |

| Swap Free Available | Yes | Yes | Yes |

| Maximum lot size | 1000 | 500 | Unlimited |

| Order execution | from 0.16 sec | from 0.16 sec | from 0.16 sec |

| Margin call | 30% | 30% | 30% |

| Stop out | 0% | 0% | 0% |

The Cent account is ideal for beginners starting with just $1, trading micro lots. The Standard account includes all costs in the spread, while the Pro account offers raw spreads from 0.0 pips and suits experienced traders looking for tighter costs and higher volume.

🧪 Demo Account

Headway provides free demo accounts on MetaTrader 4 and 5. These accounts simulate live market conditions and help traders practice strategies across CFDs on forex, commodities, indices, shares, and crypto—without risking real money.

🕌 Islamic Account

Headway offers a swap-free account option that complies with the principles of Sharia law.

⚖️ What Is CFD Leverage?

CFD trading offers the advantage of leverage, allowing traders to control large positions with relatively small deposits. At Headway, leverage can go up to 1:Unlimited for accounts with balances up to $1,000—though this carries a high level of risk and is only unlocked after trading 5 standard lots on a real account.

| Asset Class | Maximum Available Leverage |

|---|---|

| Forex | 1:Unlimited |

| Metals | 1:Unlimited |

| Energies | 1:200 |

| Indices | 1:400 |

| Cryptocurrencies | 1:400 |

| Shares | 1:20 |

📊 Leverage by Account Balance

| Account Balance | Maximum Leverage |

|---|---|

| 0 – $1,000 | Unlimited (after trading 5 lots) or up to 1:2000 |

| $1,001 – $5,000 | up to 1:2000 |

| $5,001 – $20,000 | up to 1:1000 |

| $20,001 – $30,000 | up to 1:800 |

| $30,001 – $50,000 | up to 1:600 |

| $50,001 – $80,000 | up to 1:400 |

| $80,001 – $100,000 | up to 1:300 |

| > $100,001 | up to 1:200 |

🚫 Restricted Countries

Headway Inc. does not provide services to residents of countries that are currently listed, were previously listed, or may be listed in the future on the FATF blacklist.

🎓 Education

Headway’s educational offering is well-structured and beginner-friendly, designed to help traders build confidence and competence as they explore the financial markets.

The Education section includes:

✅ Actionable Trading Strategies – Ideal for those just starting out, these strategies are written in a clear and practical manner.

✅ Trading Basics – Articles cover essential topics such as order types, leverage, and risk management.

✅ Advanced Concepts – More seasoned traders can explore topics like backtesting automated strategies and optimizing Expert Advisors (EAs).

One of the highlights is the ‘Forex for Beginners’ course, which offers:

Core lessons on technical and fundamental analysis

Visual learning with rich illustrations and chart examples

A strong focus on concept clarity, including trend lines, support/resistance, and chart patterns

Interactive quizzes to reinforce learning and track progress

In addition to written materials, Headway provides video-based tutorials on its official YouTube channel, helping traders navigate popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

📹 The tutorials are particularly helpful for visual learners and cover both basic navigation and more advanced features such as using indicators, setting stop-losses, and placing different order types.

Suggestion for Improvement:

Adding live webinars, certification pathways, or market analysis videos could elevate Headway’s education center to a more competitive level in the industry.

✅ The Bottom Line

Headway is a regulated broker under South Africa’s FSCA with just over two years in operation. While still relatively new, it has already built a user-friendly and accessible trading environment that caters well to beginner and casual traders.

🟢 Strengths:

Fast onboarding and intuitive client portal

Competitive spreads in major markets like EUR/USD and DAX 40

Rich selection of instruments, especially in crypto and indices

Above-average educational content with courses, strategies, and platform tutorials

Well-designed copy trading platform and mobile app

🔴 Areas for Improvement:

Lacks real-time market analysis and news coverage

Could benefit from a wider variety of research tools and in-depth analytical reports

No phone support available in customer service

Overall, Headway delivers a solid trading experience for newcomers to the market. Its simplicity, educational value, and innovative features like copy trading make it a great starting point for retail traders looking for flexibility and ease of use.

🎁 Headway Bonus Program

Headway offers several promotional bonuses designed to attract and retain traders. These bonuses vary depending on promotions, and may include:

- Welcome Bonus: Extra trading credit for newly registered accounts.

- Deposit Bonus: A percentage of your deposit added as bonus funds.

- Cashback/Trading Rebate: Rebates or cashback based on trading volume.

Note: Bonus terms and conditions apply. Always check the official website for the latest offers and eligibility requirements.

📺 Watch: Headway Broker Review

For a quick overview of Headway’s key features, trading platforms, and account types, watch the detailed video review below: