Leverage is one of the most powerful tools in forex trading—and when used correctly, it can help amplify your returns significantly. If you’re trading on Exness, you’ve probably seen leverage options ranging from 1:100 to even unlimited leverage. But how does leverage really work, and how can you use it wisely without wiping out your account?

In this guide, we’ll break down everything you need to know about Exness leverage, from how it works to the best practices for risk management. Whether you’re a beginner or an experienced trader, this article will help you understand how to make the most of leverage safely.

🔍 What is Leverage in Forex Trading?

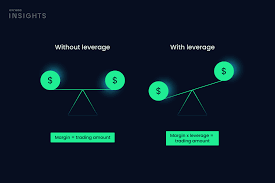

Leverage allows you to control a larger trade size with a smaller amount of your own capital. It’s essentially a loan provided by your broker—in this case, Exness—to increase your buying or selling power.

Example:

If you trade with 1:100 leverage and deposit $100, you can control a position worth $10,000.

| Leverage | Deposit | Trade Size |

|---|---|---|

| 1:1 | $100 | $100 |

| 1:100 | $100 | $10,000 |

| 1:2000 | $100 | $200,000 |

🧠 Key Idea: Leverage magnifies both gains and losses. A small market move can lead to large profit—or loss.

📌 Types of Leverage Offered by Exness

Exness is known for offering flexible and high-leverage options, including unlimited leverage in some cases.

Here are the common leverage types Exness provides:

| Account Type | Maximum Leverage |

|---|---|

| Standard | Up to Unlimited |

| Pro | Up to 1:2000 |

| Zero & Raw Spread | Up to 1:2000 |

| Cent Account | Up to Unlimited |

✅ Unlimited Leverage

-

Available only after certain conditions are met (e.g., trading volume ≥ 5 lots, 10 closed orders)

-

Useful for experienced traders who manage risk strictly

⚙️ How Does Exness Leverage Work?

Let’s say you have a $500 deposit and you’re using 1:100 leverage.

-

Your available margin becomes: $500 × 100 = $50,000

-

That means you can open positions worth up to $50,000

-

A 1% move in your favor equals $500 profit

-

But a 1% move against you = full loss of your deposit

This is why leverage must be used responsibly.

🎯 How to Set Leverage in Your Exness Account

You can change your leverage at any time by following these steps:

-

Log in to your Exness Personal Area

-

Select your trading account

-

Click “Change Leverage”

-

Choose a leverage ratio (e.g., 1:100, 1:1000, or unlimited)

-

Confirm your selection

⚠️ Note: Leverage changes only apply to new positions, not existing trades.

📉 Margin Requirements and Leverage

As leverage increases, the required margin for each trade decreases. However, this also means your risk increases.

| Leverage | Margin Required for $100,000 Trade |

|---|---|

| 1:50 | $2,000 |

| 1:100 | $1,000 |

| 1:500 | $200 |

| 1:2000 | $50 |

💡 Exness provides a margin calculator to help you determine required margin based on your lot size, leverage, and currency pair.

🚨 Risks of Using High Leverage

While high leverage sounds attractive, it carries several risks:

1. Rapid Account Loss

A small unfavorable price movement can trigger a margin call or stop-out level, wiping your account fast.

2. Overtrading

Traders often open large positions just because they can, ignoring proper risk-reward ratios.

3. Emotional Trading

High leverage leads to more volatile equity swings, making you prone to fear and greed-based decisions.

🧠 How to Use Exness Leverage Wisely

✅ 1. Use Low Leverage as a Beginner

If you’re new to forex, stick to 1:50 or 1:100 until you understand the market well.

✅ 2. Risk Only 1–2% Per Trade

Use a position sizing calculator to make sure you’re only risking a small percentage of your balance.

✅ 3. Monitor Margin Level %

Keep an eye on your margin level in MetaTrader. A drop below 60% can lead to auto-close of trades by Exness.

✅ 4. Use Stop-Loss Orders

Always set a stop-loss to cap your potential loss, especially when using leverage higher than 1:100.

✅ 5. Test Leverage on Demo First

Try different leverage settings on an Exness demo account to see how your strategy performs without risking real money.

📊 Exness Stop Out and Margin Call Levels

| Account Type | Margin Call Level | Stop Out Level |

|---|---|---|

| Standard | 60% | 0% |

| Pro | 60% | 30% |

| Zero | 60% | 30% |

| Raw Spread | 60% | 30% |

🔎 Stop-out means Exness will automatically close your positions to prevent a negative balance.